In the last couple of years, green solutions are starting to take the limelight in a bid to make the world a better place for future and current generations. Various industries are becoming more socially responsible when it comes to green solutions but one field that can really make a difference in real estate.

When it comes to real estate, one of the best innovations in recent memory is green mortgages. You might have heard of this already and it’s easily a change in real estate that can make a real difference. What are green mortgages and why should you consider looking into them?

What Is A Green Mortgage?

To put it in simpler terms, a green mortgage is a type of mortgage where the house buyer is offered incentives, preferential terms, or benefits if the property they are getting is able to meet certain environmental standards. It can potentially help promote greener structures in the future.

This type of mortgage will not just apply when a home buyer purchases a property that meets the standards. You can also get the incentives when you build a home reaching the standards or you renovate an old one to meet the same standards as well. To be more specific, a green mortgage is about creating green buildings.

While green mortgages are definitely the new trend, they’ve been around for years especially in countries with a strong devotion to green solutions. As per Lan For Deg, Norway has been doing it for years already. They expect it to perform just as well for other countries as it did for them simply because it provides a win-win solution for home buyers and mortgage loaners.

Now that you’ve heard about it and you want to make a difference, it might be a good idea to begin thinking about your future plans with green mortgages. If you still aren’t sold on the idea, then learning about its benefits might just help enlighten you even further.

1. Secure A Home Easily

A lot of millennials and young adults are having trouble buying their first home simply because the housing market is less forgiving. Rates are extremely high and wages are generally low. The only way to purchase a home is to secure a mortgage – most of which have unjustifiable interest rates.

For the most part, green mortgages can also help make home buying easier. Aside from better rates, you can also get incentives by choosing to live in an innately eco-friendly property. For many homeowners, this is a great deal as most home loans are really not good deals to get into.

Remember, green mortgages aren’t just about homes. They are also about business properties too. If you want to find a home for your business, then it would be a good idea to consider taking out a green mortgage instead because of the benefits and incentives.

2. Find Funding For Home Renovations And Fixes

Renovations and fixing home problems can be quite costly. Getting a green mortgage can be a good way to find funding for your home renovation. You’re giving your home eco-friendly upgrades at the same time too! You can get those upgrades without a sweat.

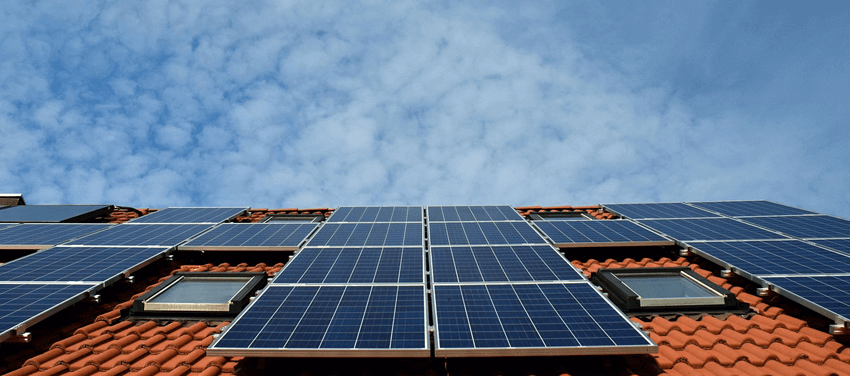

However, keep in mind that not all upgrades are covered by green mortgages. Of course, the changes you need to make to your home need to benefit the environment. To qualify for green mortgages, 50% of the funding should be used for green upgrades. These include solar panels, eco landscaping, and a lot more.

For the most part, this is where green mortgages are used.

3. Create Better Branding For Your Business

On the topic of establishing a business that operates on an eco-friendly building, you can potentially create better branding for your business through green mortgages. People are more supportive of companies that are socially responsible, hence the creation of socially responsible investing.

If your business operates in a building that uses things like solar energy and incorporates greenery into the surrounding area, you can expect more support from the local community as well. This type of branding helps businesses grow and it could be a good way to create a sustainable business at that.

4. Help Provide You With Better Utility Options

A part of what green mortgages are about is helping you have a home that’s more efficient when it comes to energy consumption. Instead of the traditional way to get power, green mortgages promote the use of solar energy. This in itself is a big benefit but more on that in a bit.

Solar energy offers a ton of benefits but the problem is that installation costs can be heavy. This puts off most people that want to shift towards this more reliable and eco-friendly source of energy. With green mortgages however, people can avail loans for the necessary upgrades in better terms.

While expensive upfront, solar energy is a good way to save on utilities. Owners of solar energy panels report cutting at least 70% off of their utility bills upon making the shift. Eventually, the investment will pay for itself. On top of it all, you are helping save the environment as well.

The monthly savings you make from solar energy can then be used to support the payment you make for the loan monthly. It’s a good system that will reward you well in the future too.

5. Provide A Better World For Yourself And Your Children

Of course, the most important benefit of green mortgages is that they can help provide a better future world to live in. At its current state, scientists have been persistently warning that we are doing more and more damage to this planet with each passing year.

Being able to promote eco-friendly homes will not only result in a better future, but it can also even result in a better today. In essence, green mortgages are and will always be about making the world a better place. Just think of the impact an entire city can make if all homes and buildings become eco-friendly.